Bitcoin

Three Arrows Capital’s $1.53 Billion Claim Against FTX Approved by U.S. Bankruptcy Court

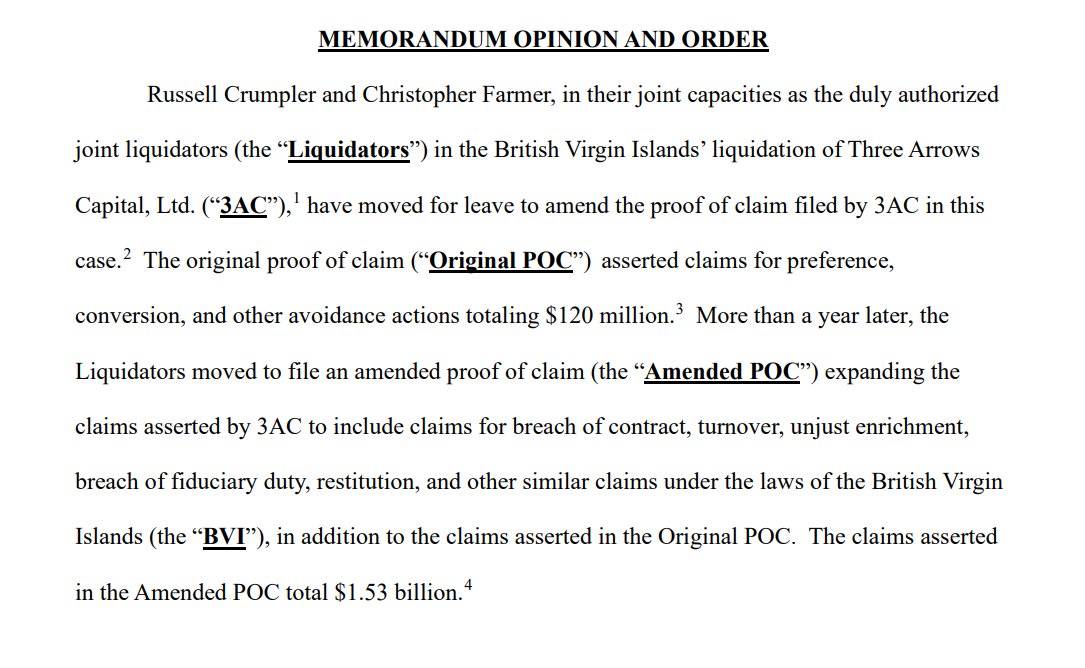

A U.S. bankruptcy court has granted liquidators of Three Arrows Capital (3AC) permission to significantly elevate their claim against the collapsed cryptocurrency exchange FTX from $120 million to an astounding $1.53 billion. This pivotal decision marks a notable development in the ongoing fallout from FTX’s dramatic downfall, which captured headlines throughout 2022.

A recent ruling dated March 13 by the U.S. Bankruptcy Court for the District of Delaware adjudicated on 3AC’s motion to amend its proof of claim. During the court proceedings, the presiding judge determined that FTX must compensate 3AC to the tune of $1.53 billion. This revised claim represents a marked increase from the initial filing, which was submitted in June 2023. FTX contested this ruling, arguing that the amendment was both tardy and would unnecessarily impede its bankruptcy proceedings. However, the judge sided with the liquidators, reasoning that adequate notice regarding the claim had been furnished. Moreover, the court concluded that delays in filing were largely attributed to FTX’s failure to promptly produce essential records that 3AC’s liquidators required to comprehensively evaluate and substantiate their claim.

The 3AC liquidators assert that FTX possessed approximately $1.53 billion worth of 3AC assets, which were subsequently liquidated to address 3AC’s outstanding debts. Furthermore, they maintained that the transactions in question were avoidable and contested FTX’s failure to disclose critical information that could have revealed the liquidation’s circumstances. This argument highlights the ongoing complexities surrounding asset recoveries in the cryptocurrency sector, notorious for its regulatory ambiguities and operational challenges.

Once leaders in the cryptocurrency arena, both Three Arrows Capital and FTX now face dire repercussions following their respective downfalls. Established in 2012, 3AC rapidly became one of the most significant crypto hedge funds until its collapse in June 2022, stemming from forced liquidations linked to overleveraged positions in key cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). The firm subsequently filed for bankruptcy in July 2022. Since then, liquidators have been diligently working to recover lost funds by liquidating remaining assets and initiating various lawsuits, primarily against FTX and Terraform Labs, to ensure repayments to creditors.

FTX, on the other hand, filed for bankruptcy in November 2022 amid a scandal that revealed serious liquidity issues, leading to its abrupt collapse. The exchange has sought to recover funds through a series of lawsuits, including actions against crypto giant Binance and CEO Changpeng Zhao. Recently, FTX began its repayment process via strategic collaborations with BitGo and Kraken exchanges, marking a critical step in its effort to restore some financial stability amid the chaos of its bankruptcy proceedings.

As liquidators for both entities press forward with their pursuits, the unfolding legal battles underscore the ripple effects of the cryptocurrency market’s volatility and lack of regulatory oversight. In light of this tumultuous landscape, the implications of the court’s ruling extend beyond the immediate parties involved, resonating throughout the broader financial ecosystem. Stakeholders and investors within the crypto space are closely monitoring developments, as outcomes from cases like these may set important precedents for how bankruptcy claims and asset recoveries unfold in the volatile world of cryptocurrency.

The scrutiny over FTX’s financial practices and the liquidators’ claims highlights ongoing concerns regarding transparency and accountability in the cryptocurrency sector. As more details emerge from court proceedings, they may provide further insights into how similar insolvencies may be navigated in the future. The cited ruling represents not only a significant escalation in the struggle for asset recovery between 3AC and FTX but also an illustration of the far-reaching consequences such collapses can have on the entire financial landscape within the digital asset domain.

-

Press Releases2 years ago

Press Releases2 years agoGaming Technologies of the New Time!

-

Altcoins10 months ago

Altcoins10 months agoBitcoin Declines Below $80K: deVere CEO Nigel Green Remains Bullish on Long-Term Outlook Following Strategic U.S. Bitcoin Reserve Announcement

-

Bitcoin1 year ago

Bitcoin1 year agoBitcoin Surges Past $64K as SEI and POPCAT Lead Daily Crypto Gains on September 25

-

Altcoins10 months ago

Altcoins10 months agoCalls for Enhanced Discussion on Bitcoin as Brazil’s Reserve Asset: A Move Towards ‘Internet’s Gold’

-

Press Releases2 years ago

Press Releases2 years agoEvo Exchange: Redefining the Decentralized Exchange Landscape

-

Bitcoin6 months ago

Bitcoin6 months agoGrayscale Investments Submits Draft Registration for IPO, Aiming for Public Trading in U.S.

-

Press Releases1 year ago

Press Releases1 year agoCODE, a Newly Born Project Brings Decentralization Back to the Main Menu

-

Bitcoin6 months ago

Bitcoin6 months agoPeter Schiff Critiques New Crypto Legislation, Claims Bitcoin (BTC) Gains are Short-Lived